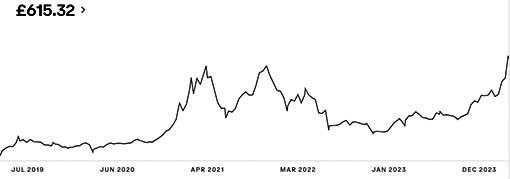

Woohoo! Lookatit GO!

My Bitcoin balance. A reminder that I bought of £50 it in the Spring of 2019. I intended to buy regular small amounts, but my only UK ID expired so I wasn’t allowed. From then on, I could only watch.

That there graph is the movement of £50 and £50 only during the last five years.

I’m thinking of returning to the original plan and putting a small sum by every month, the original plan. I know it could all go bust, but I won’t be out much. But somehow, having this one pristine index has a huge appeal. Maybe I’ll open an account somewhere else.

Today was my first day out of the house in six days, and that was to go shop for symptom relief. Not the worst cold I’ve ever had, but it is a bitter clinger.

Can you imagine what my inbox will look like tomorrow?

Posted: March 11th, 2024 under personal.

Comments: 4

Comments

Comment from ExpressoBold Pureblood

Time: March 11, 2024, 8:56 pm

How and where do you cash in your Bitcoin Riches… and who decided what the fiat currency equivalence amount is?

Good luck on the symptoms relief; you should see if you can mail order some ivermectin – that is gooood stuff!

I assume by “inbox” you mean the one at work.

That’s about all. Peace out.

Comment from peacelovewoodstock

Time: March 12, 2024, 12:25 pm

Bitcoin will undergo a quadrennial “halving” in April and based on past halving events plus the recent approval of Bitcoin ETFs, many market watchers are predicting a strong bull run to continue at least through next year with reasonable target price at $100K + per BTC (currently at about $70K).

Michael Saylor, the Microstrategy billionaire, is all-in on Bitcoin. Check out his recent speech at Bitcoin conference in Madeira, it’s on YouTube.

Comment from Some Vegetable

Time: March 12, 2024, 2:46 pm

Somehow, I have never been able to get my head around the validity of Bitcoin.

I once read a novel, Instant Gold , which left a deep impression in me.

“The year is 1964 and gold bullion is illegal to own. Private citizens are required to sell it to the government for a fixed price. Early one foggy November morning a small shop opens for business in the fashionable shopping district of downtown San Francisco. Showcased in their window is the one thing they sell. A small, nondescript can with simple lettering. Etched clearly on the plate glass window was…Instant Gold. Could alchemy be real? Three mysterious inventors open shop after shop and everyone wants something. Big business and the mob want a piece of the action. The government wants to control them, and the public just want their 8 ounces of fine gray powder to turn into solid gold. Instant Gold is a modern day fairy tale that satirizes human greed and lays bare the whole paradox of free enterprise capitalism.

Essentially, Instant Gold is like instant coffee, except when you add water to the can, you don’t get coffee, you get a can full of solid, real, gold. The cans are cheap – (the exact price doesn’t matter here). Early buyers are deemed fools, but get rich. However, eventually the market gets flooded and the value of gold crashes to nothing; the economy collapses, and Instant Gold goes off the the market.

Anyhow, the novel taught me that anything is only worth what someone will give you for it. I have long expected Bitcoin to run out of “Bigger Fools”. However, I have to say I wish that – I – had bought £50 of it years ago.

https://www.thriftbooks.com/w/instant-gold_frank-orourke/2072376/#edition=65210251&idiq=58451611

Comment from Durnedyankee

Time: March 12, 2024, 7:52 pm

Init funny how when it gets converted it isn’t converted into a physical Bitcoin coinage, but rather into a fiat currency.

Write a comment

Beware: more than one link in a comment is apt to earn you a trip to the spam filter, where you will remain -- cold, frightened and alone -- until I remember to clean the trap. But, hey, without Akismet, we'd be up to our asses in...well, ass porn, mostly.<< carry me back to ol' virginny